Review all of the transactions completed in a single month and gross sales with NuORDER Payments, using the Monthly Statements page.

Note: If you're using Lightspeed Payments, check out Review transactions and deposits.

Access monthly statements

From the left navigation menu, go to Payments > Monthly Statements.

Download a statement

Last month's statement displays in the Most Recent section. Other monthly statements for the current year are listed in the Past Statements section. To view statements from prior years, select a different year in the upper-left corner. If your business operates with multiple currencies, you can also filter by the currency.

Monthly statements are generated during the first 3 days of the following month. They’re available to download as both XLSX and CSV files. For a cleaner, more readable version of your monthly statement, we recommend the XLSX file. However, the CSV file can be helpful for easy pivot table creation and may potentially lead to faster data imports.

To download a statement, select XLSX or CSV for the month and year of your choice.

Review your statement

Your monthly statement shows you a breakdown of transactions and deposits in a given month.

This information is split across 4 tabs within your statement: Summary, Charges by Card Type, Daily Aggregate, and Settlements. Each tab can be helpful for reconciling your accounts; we’ll go into detail on how to best utilize each below.

Summary

The Summary tab displays top-level information about your account, including your payment account code.

It also provides a summary of the following for the entire month:

- Gross sales: The total value of all transactions before feed deduction.

- Fees: Any fee attached to an order (for example, processing fees).

- Manual Adjustments: Any adjustments made manually due to requests or transaction issues.

- Chargebacks / Reversals: Additional fees associated with chargebacks and refunds.

- Totals: The total deposited to your bank after adjustments and fees have been deducted from your gross sales.

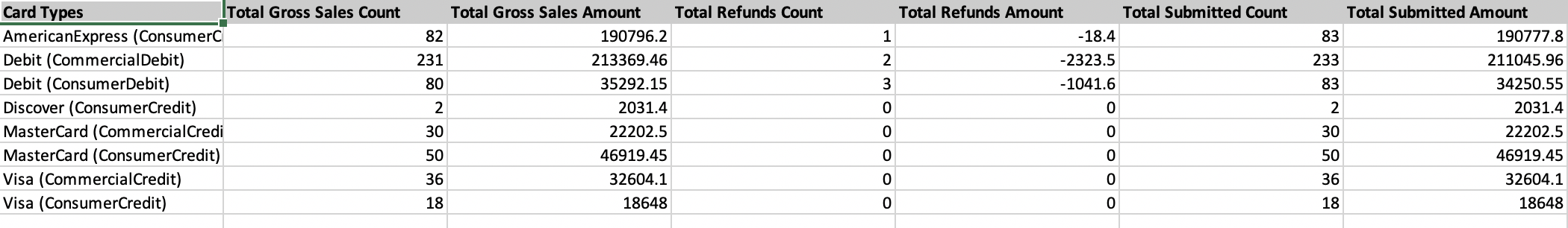

Charges by Card Type

The Charges by Card Type tab provides a breakdown of your transaction volume by card type.

It includes the following columns:

- Card Types: A list of the types of credit and debit cards used to complete transactions.

- Total Gross Sales Count: The total number of sales completed on each card type.

- Total Gross Sales Amount: The total monetary value of the transactions completed on each card type.

- Total Refunds Count: The total number of refunds requested for each card type.

- Total Refunds Amount: The total monetary value of the transactions refunded for each card type.

- Total Submitted Count: The total number of transactions submitted by each card type.

- Note: A refund is also considered a transaction; therefore, your Total Gross Sales Count may not always match the Total Submitted Count.

- Total Submitted Amount: The gross sales amount that is submitted for a deposit to your bank after refunds.

- Note: The submitted sales total is based on your gross sales. Fees will still be deducted before payment is deposited in your account.

Daily Aggregate

The Daily Aggregate tab lists your total net deposit for each day alongside a breakdown of all of the individual transactions and fees that comprise your deposit.

It includes the following columns:

- Date Submitted: The date the transaction was submitted.

- Note: Both a purchase and a refund are considered a transaction.

- Amount: The total amount of money for all transactions completed that day.

- Refunds: The total monetary value of all refunds requested; does not take into account Fees.

- Chargebacks / Reversals: Any separate fees associated with chargeback disputes that are not in your favor.

- Fees: The total monetary value of fees taken from the Amount column (inclusive of refund fees).

- Net Amount: The net amount deposited into your bank account based on that day's transactions.

Settlements

The Settlements tab shows you a batched view of all deposits sent to your bank.

It includes the following columns:

- Date Settled: The date the deposit was made to your bank.

- Batch Number: A unique code you can use to match one full "batch" of deposits to your bank deposit.

- Gross Deposit Amount: The gross total of all transactions included in the batch for a deposit.

- Some cards, such as American Express, take a bit longer to settle. If the gross total on one day seems a bit lower than expected while another seems a bit higher, it’s possible that a delay may have been caused by the card type used.

- Chargebacks: The total monetary value of chargebacks settled that day.

- Refunds: The total monetary value of refunds completed that day.

- Manual Adjustments: The total amount of any adjustments made manually to your account (e.g. a manual refund or reversal).

- Fees: The total monetary value of all fees assessed against the transactions for that day.

- Amount Deposited: The total net amount deposited to your bank.